Auto Insurance in and around Jackson

The first choice in car insurance for the Jackson area.

Time to get a move on, safely.

Would you like to create a personalized auto quote?

Be Ready For The Road Ahead

When it comes to budget-friendly car insurance, you have plenty of choices. Sorting through deductibles, coverage options, savings options… it’s a lot, to say the least.

The first choice in car insurance for the Jackson area.

Time to get a move on, safely.

Great Coverage For A Variety Of Vehicles

State Farm offers flexible reliable coverage with a variety of savings options available. You could sign up for Drive Safe & Save™ for savings up to 30%. Then there's the Steer Clear and Good Student Discounts that offer savings until you turn 25. And Vehicle Safety Features applies if your vehicle has an alarm or some other anti-theft device to deter crime. These are a few of the savings options State Farm offers! Most State Farm customers are eligible for one or more savings option. Katie Murphy can explain which ones you qualify for to make a policy for your individual needs.

This can include coverage for a variety of situations and vehicles, too, like teen driver coverage, rental car coverage or sports cars. And the benefits of State Farm don't stop there! When mishaps occur, you can be sure to receive straightforward personalized care from State Farm agent Katie Murphy. Call or email Katie Murphy's office today!

Have More Questions About Auto Insurance?

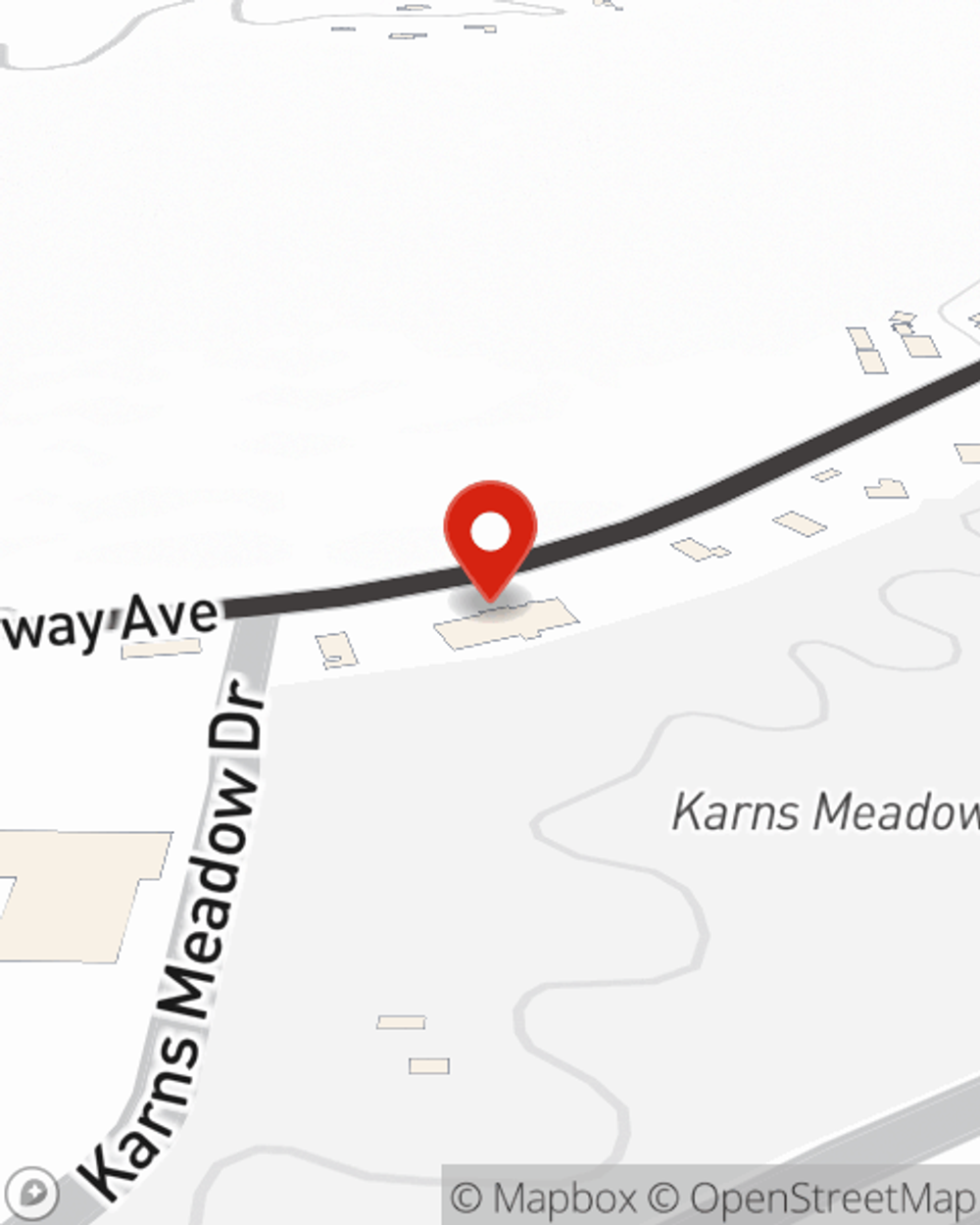

Call Katie at (307) 203-2233 or visit our FAQ page.

Simple Insights®

What to do after a car accident: A step-by-step guide

What to do after a car accident: A step-by-step guide

In a car crash? Stay calm and follow these simple steps: Check for injuries, call the police, exchange info, document the scene and report to your insurer.

Katie Murphy

State Farm® Insurance AgentSimple Insights®

What to do after a car accident: A step-by-step guide

What to do after a car accident: A step-by-step guide

In a car crash? Stay calm and follow these simple steps: Check for injuries, call the police, exchange info, document the scene and report to your insurer.